Millennial Executive: Organize Your Life (Finally) in 2018

January 22, 2018

This Week in Getting Hacked: OnePlus Gets Pwned Edition

January 25, 2018I started off the week with great anticipation about this piece. Working in the techspace, I obviously knew about cryptocurrency, but when asked by friends and family questions like, “What is a Bitcoin?,” I could never fully explain.

So when this article came across the editorial calendar, I audibly exclaimed in my office that I’d finally be able to answer their questions and some of my own as well.

However, after two-and-a-half days of research, I find myself 200 percent more unsure of how to answer that question.

Sure, I can explain to them the textbook definition of Bitcoin, but I don’t believe that fully explains why cryptocurrency is such a big deal these days.

I mean, have you looked at the stock prices recently!?

Therefore, I decided to change this article from strictly an informational piece to more of a thoughtful one. Sure, we’ll discuss what cryptocurrency is, a little bit of the history behind it, and what it all means for the future of money—but there’s the lingering question in my mind (and from surveying my coworkers around the office, I’m not alone on this) about what the intrinsic value of cryptocurrency actually is?

Why do people take out second mortgages to invest in something that’s not regulated by any type of historically-deemed authority figure(s)?

I doubt I, a lonely technology blogger, have the gumption to provide the answer to these questions, but perhaps we can discover a different worldview on cryptocurrency together as we work through this article.

Let’s not dawdle any further.

What Is Cryptocurrency?

The Very Beginning

Cryptocurrency, surprisingly, can trace its origins to the early 1980s at the genesis of the Internet.

This is not the cryptocurrency as currently constructed, but rather people trying to figure out how to get paid and pay for things over the Internet.

You have to think—this was before services like PayPal and before banks and credit companies adopted online services. This was before HTTPS and in-browser payment processing. There had to be an intermediary.

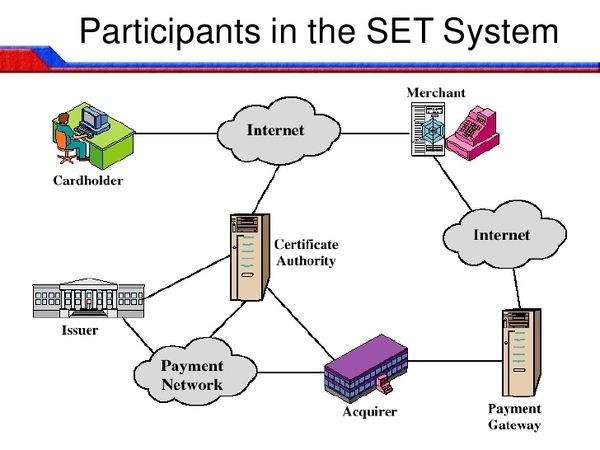

In the mid 1990s, a standard developed by Visa and Mastercard (along with Microsoft, Netscape, IBM, Verisign, and RSA) called SET (Secure Electronic Transaction) changed the way payments were processed online.

Here’s how it worked:

An early adopter of SET for online transactions was a company called CyberCash. They had a digital cash product they called CyberCoin.

CyberCoin was a micropayment system designed to hold small amounts of money to pay for newspaper subscriptions and the like. Most users didn’t have more than $10 in their account at any time, but the United States government insured them up to $100,000 for each account.

CyberCoin, as you might have guessed, worked much like PayPal, but there was a catch.

An old restriction put in place by the United States government considered cryptography as a weapon, but the U.S. allowed it anyways. (Oh, CyberCash was affected by Y2K and went bankrupt in 2001. Yes, Y2K…).

SET didn’t really work because of the certificates needed which basically meant that every person/entity involved in the transaction had to have a key, which is a huge hassle.

More surprisingly, some banks tried to adopt these early forms of cryptocurrency, but not surprisingly none really caught on.

Eventually, browser-based payment processing that we’re all familiar with was the adopted way to perform commerce on the Internet, but cryptocurrency is trying to change all of that.

How Bitcoin Got Started

For the sake of keeping this article concise, I decided to focus on what is the most recognizable (and first) form of contemporary cryptocurrency out there: Bitcoin.

Bitcoins appeared, according to most sources, but this isn’t 100 percent for sure, from generally nowhere from the mind of Satoshi Nakamoto in 2009. He helped forged the modern-day definition of cryptocurrency.

In fact, every cryptocurrency that was invented after Bitcoin (Litecoin, Peercoin, Feathercoin, etc.) are called alternative coins or altcoins.

What is Bitcoin?

Bitcoin, at its most simplest is lines of computer code that hold monetary value. That’s it. Those lines of code are created by powerful computers and computer-networks churning around the clock to solve complicated math problems to earn fractions of one Bitcoin.

The machines which create lines of Bitcoin are known as miners, a common term in today’s tech-vernacular.

World governments have no control over Bitcoin and that’s one of the things that makes them so popular.

You can also store your mined Bitcoin offline in a hard drive or USB stick which makes them about as secure as cash at that point. This is called cold-storage (which is different from the hot and cold storage we normally write about). Hot storage of Bitcoins is storing them online in the cloud or wherever, which is considered much easier to steal.

Bitcoin was created with a market cap in mind, and only 21 billion Bitcoin can ever be mined, making their value increase over time.

About half of that 21 billion has been mined since 2009.

Look at it this way. On your suped-up gaming computer at home, you can sign up to mine Bitcoin and your machine will start using its power to mine. After a few days, your machine will have solved maybe one math problem and be rewarded a fraction of Bitcoin valued at ~$3.00.

However, your machine really had to work to get that problem solved and consumed a ton of power in doing so. Say, your cost of powering the machine was ~3.05. You just lost $.05 after those few days.

So, you supe-up your machine even more and you start to make a profit, but you have to pay off your computer first.

So the upfront cost of mining actual Bitcoin can get there.

That’s why some people team up and link their machines together to use the combined processing power and mine more efficiently.

However, most people end up just investing instead of actually mining.

Every single Bitcoin is tracked. The user isn’t tracked, but the Bitcoin and any transaction using the Bitcoin is tracked with a Bitcoin wallet and published online. It’s fully transparent that way and, in my opinion, is one of the strongest aspects of Bitcoin.

Why?

That’s it. People have assigned these lines of code a monetary value, but what value does it actually have?

Honestly, it’s not much different than cash and that’s a good thing. You’re solely responsible for the security of your Bitcoin, via not losing or compromising your storage and making sure your cybersecurity is up to snuff.

But where’s the actual value?

Maybe I’m too old-school and need to think more out of the box. With that said, let’s take a break and revisit some of these questions in Part 2 next week. We’ll also take a look at how Bitcoin and altcoins have evolved since 2009, how the stock market looks, and look a little bit into the future.